Florida Quiet Title Lawyer | Clear Title in Miami-Dade and South Florida

If you cannot sell, refinance, insure, or develop a property because of a cloud on title, a quiet title action may be the path to a clean, marketable title. Revah Law brings quiet title actions to address common title defects such as unreleased liens, missing heirs, old mortgages, recording errors, and competing claims of ownership.

Revah Law represents clients in Miami-Dade, Broward, and Palm Beach Counties, and throughout South Florida.

If you need help with this issue, contact Revah Law to discuss next steps and strategy.

Governing Florida Law

Quiet title actions in Florida are governed by Chapter 65, Florida Statutes.1 Depending on the issue, quiet title cases may also involve tax deed notice statutes or other title-related statutory schemes.3

Table of Contents

- What is a Quiet Title Action?

- Common Title Defects in Florida

- The Quiet Title Process in Florida

- Types of Quiet Title Actions in Florida

- The Role of a Quiet Title Attorney

- The Importance of Title Insurance and Title Searches

- The Role of a Title Company in Real Estate Transactions

- Quiet Title Actions and Real Estate Investments

- Frequently Asked Questions (FAQ)

What is a Quiet Title Action?

A quiet title action is a lawsuit filed in a court of law to establish ownership of real property. The purpose of a quiet title action is to “quiet” any challenges or claims to the title, thereby removing any “clouds” on the title and establishing a clear, marketable title. This is essential for anyone who wants to sell, refinance, or otherwise transfer their property. A Florida quiet title attorney can guide you through this process and help you secure your ownership rights.

Why is a Clear Title Important?

A clear title is essential for any real estate transaction. When you sell a property, the buyer will want to be assured that they are receiving a clear title, free from any liens, encumbrances, or other claims. Similarly, when you refinance a property, the lender will require a clear title to secure their loan. If there are any clouds on the title, it can delay or even prevent a sale or refinancing. A quiet title action can resolve these issues and provide you with a clear, marketable title.

What is a “Cloud” on a Title?

A “cloud” on a title is any document, claim, or encumbrance that might affect the owner’s rights to the property. This can include things like an old mortgage that was never satisfied, a lien from a creditor, a claim from a previous owner, or an error in the public records. A quiet title action is used to remove these clouds and to establish a clear title. An experienced Miami quiet title lawyer can help you identify any clouds on your title and can take the necessary steps to remove them.

When is a Quiet Title Action Necessary?

A quiet title action may be necessary in a variety of situations. These include when there is a dispute over the ownership of a property, when there is an error in the public records, when there is an old lien or mortgage that was never satisfied, when a property has been acquired through a tax deed sale, when a property has been acquired through adverse possession, or when there is a boundary dispute with a neighboring property owner. If you are facing any of these situations, a quiet title action Florida attorney can help you determine the best course of action.

Common Title Defects in Florida

Title defects can arise from a variety of sources and can take many forms. Understanding the common types of title defects can help you identify potential issues with your own property. A Florida quiet title attorney can conduct a thorough title search to identify any defects and can advise you on the best way to resolve them.

Liens and Judgments

Liens and judgments are among the most common types of title defects. A lien is a legal claim against a property that is used as collateral for a debt. Common types of liens include mortgage liens, tax liens, mechanic’s liens, and judgment liens. If a lien is not satisfied, it can remain on the title and can affect the owner’s ability to sell or refinance the property.

Errors in Public Records

Errors in the public records can also create title defects. These can include mistakes in the legal description of the property, misspelled names, or incorrectly recorded documents. Even a small error can create a cloud on the title and can cause problems when you try to sell or refinance the property.

Unknown Heirs and Missing Owners

When a property owner dies, their property is typically transferred to their heirs through the probate process. However, if an heir is unknown or cannot be located, they may still have a claim to the property. This can create a cloud on the title that can be difficult to resolve without a quiet title action.

Forged Documents

Forged documents are a serious type of title defect. If a deed or other document in the chain of title was forged, it may not be valid, and the property may not have been properly transferred. A Miami quiet title lawyer can investigate the chain of title to identify any potentially forged documents.

Boundary Disputes

Boundary disputes can also create title defects. If there is a disagreement between neighboring property owners about the location of the property line, it can affect the title to both properties. A quiet title action can be used to establish the correct boundary line and to clear the title.

Easements and Encroachments

Easements and encroachments can also affect the title to a property. An easement is a right to use another person’s property for a specific purpose, such as a right of way. An encroachment is when a structure or other improvement extends onto a neighboring property. If an easement or encroachment is not properly recorded, it can create a cloud on the title.

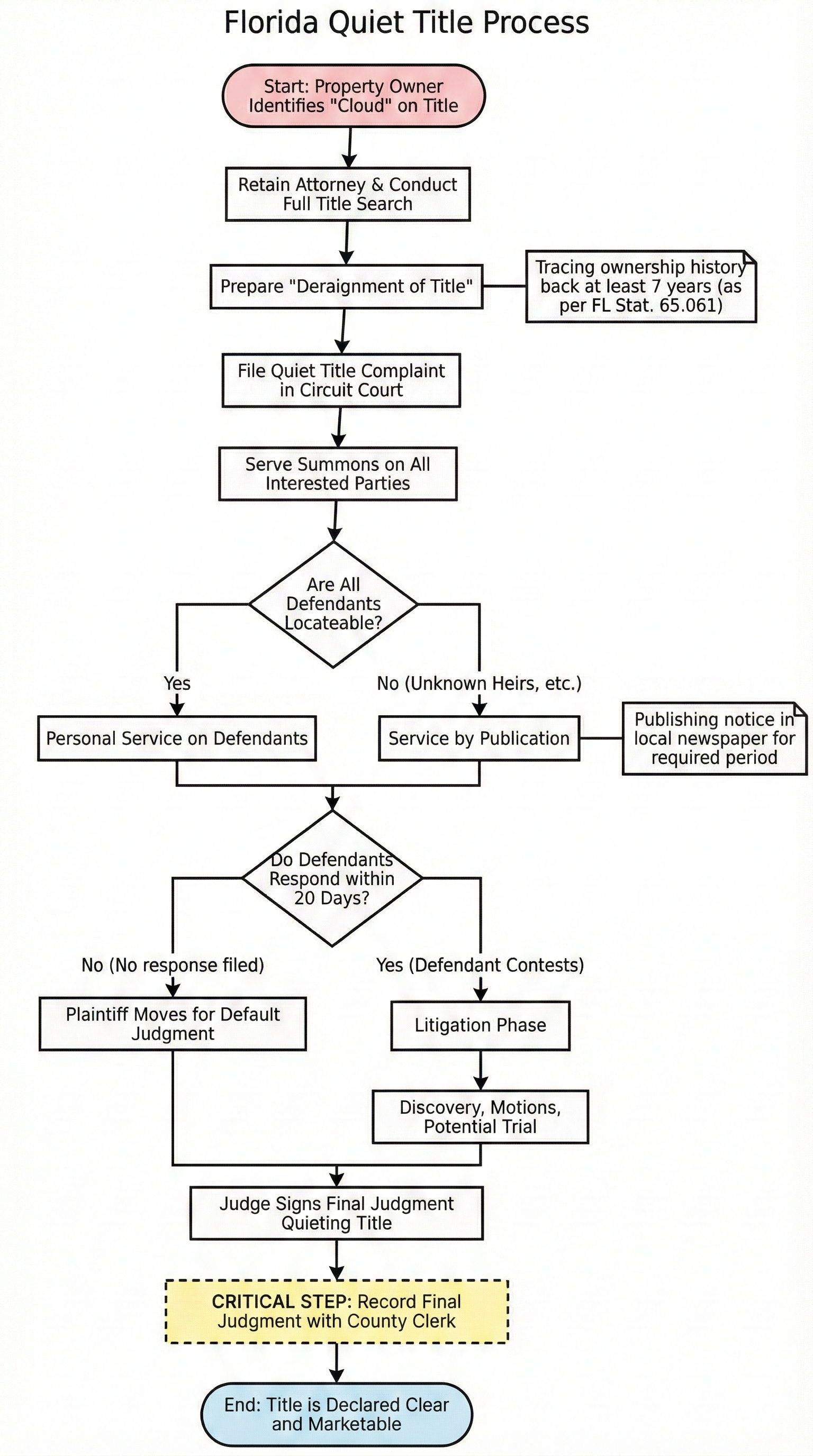

The Quiet Title Process in Florida

The quiet title process in Florida is a judicial proceeding that involves filing a lawsuit with the court. The process can be complex and time-consuming, but it is the only way to obtain a court order that definitively establishes your ownership of a property. A Florida quiet title attorney can guide you through each step of the process.

Filing the Complaint

The first step in a quiet title action is to file a complaint with the circuit court in the county where the property is located. The complaint must identify the property, describe the plaintiff’s claim to the property, and identify all potential claimants to the property. The complaint must also include a legal description of the property and a statement of the facts that support the plaintiff’s claim.

Serving the Defendants

After the complaint is filed, all potential claimants (defendants) must be served with a copy of the complaint and a summons. This is a critical step in the process, as the court cannot enter a valid judgment unless all defendants have been properly served. If a defendant cannot be located, the plaintiff may be able to serve them by publication in a local newspaper.

The Defendants’ Response

After being served, the defendants have a certain amount of time to file a response to the complaint. If a defendant fails to respond, the plaintiff can ask the court for a default judgment. If a defendant does respond, the case will proceed as a contested lawsuit.

Discovery and Trial

If the case is contested, both parties will have the opportunity to conduct discovery, which is the process of gathering evidence and information. This can include written questions (interrogatories), requests for documents, and depositions. After discovery is complete, the case may go to trial, where a judge will hear the evidence and make a decision.

The Final Judgment

If the plaintiff is successful, the court will enter a final judgment that declares the plaintiff as the owner of the property and extinguishes any claims by the defendants. This judgment should be recorded in the public records to provide notice to the world of the plaintiff’s clear title.

Types of Quiet Title Actions in Florida

While the general purpose of a quiet title action is to clear a title, there are different types of quiet title actions that can be used depending on the specific circumstances of the case. An experienced Florida quiet title attorney can help you determine which type of quiet title action is appropriate for your situation.

Traditional Quiet Title Action

A traditional quiet title action is used to resolve a specific title defect, such as a lien, a mortgage, or a claim from a previous owner. The plaintiff in a traditional quiet title action must have a valid claim to the property and must be able to prove that the defendant’s claim is invalid.

Quiet Title Action Based on Adverse Possession

A quiet title action can also be used to obtain a court judgment declaring ownership of a property through adverse possession. To succeed in a quiet title action based on adverse possession, the plaintiff must prove that they have possessed the property for at least seven years and that their possession has been open, notorious, hostile, and exclusive.

Quiet Title Action to Clear a Tax Deed

When a property is sold at a tax deed sale, the new owner receives a tax deed, but the title may still be subject to other liens and encumbrances. A quiet title action can be used to extinguish these other claims and to provide the new owner with a clear and marketable title. This is a common and necessary step for anyone who has purchased a property at a tax deed sale.

Quiet Title Action to Remove an Easement

An easement is a right to use another person’s property for a specific purpose. If an easement is no longer valid or has been abandoned, a quiet title action can be used to have it removed from the title. This can be a complex process, as it may involve proving that the easement is no longer necessary or that it has been abandoned by the easement holder.

Quiet Title Action to Resolve a Boundary Dispute

If there is a disagreement between neighboring property owners about the location of the property line, a quiet title action can be used to have the court establish the correct boundary line. This can involve a survey of the property and a review of the historical records. A Miami quiet title lawyer can help you navigate the complexities of a boundary dispute and can represent you in a quiet title action to resolve the issue.

The Role of a Quiet Title Attorney

Navigating a quiet title action can be a legally complex and procedurally detailed process. Given the significant investment that real estate represents, ensuring that you have a clear and marketable title is of utmost importance. This is where the expertise of a Florida quiet title attorney becomes invaluable. An experienced attorney can guide you through every step of the process, from identifying title defects to obtaining a final judgment that secures your ownership rights.

Why You Need a Quiet Title Attorney

A quiet title action is not a simple administrative filing; it is a lawsuit that requires a thorough understanding of real estate law, civil procedure, and evidence. Attempting to handle a quiet title action on your own can lead to costly mistakes, such as failing to properly notify all interested parties or failing to present a legally sufficient case to the court. An experienced Miami quiet title lawyer can help you avoid these pitfalls and ensure that your quiet title action is handled correctly and efficiently.

How a Quiet Title Attorney Can Help

A quiet title attorney can provide a wide range of services to help you clear your title. For title examination, an attorney will conduct a thorough examination of the public records to identify any and all potential clouds on your title. For legal analysis, an attorney will analyze the title defects and determine the best legal strategy for resolving them. For drafting and filing the complaint, an attorney will draft a legally sufficient quiet title complaint and file it with the appropriate court. For serving all parties, an attorney will ensure that all potential claimants are properly served with the lawsuit, which is a critical step for obtaining a valid judgment. For litigation, if the quiet title action is contested, an attorney will represent you in court, presenting evidence and legal arguments to support your ownership claim. For obtaining and recording the final judgment, an attorney will ensure that the final judgment is properly drafted and recorded in the public records to provide notice to the world of your clear title.

What to Look for in a Quiet Title Attorney

When choosing a quiet title attorney, it is important to select a lawyer with experience in real estate litigation and quiet title actions. Look for an attorney who is knowledgeable about Florida real estate law and who has a proven track record of success in handling these types of cases. It is also important to choose an attorney who is a good communicator and who will keep you informed about the progress of your case. A reputable attorney will offer a free initial consultation to discuss your case and explain your options.

The Importance of Title Insurance and Title Searches

Before purchasing any property, it is crucial to conduct a thorough title search and to obtain title insurance. A title search is a review of the public records to determine the ownership of a property and to identify any liens, judgments, or other encumbrances on the title. Title insurance is a type of insurance that protects a property owner or lender against any losses that may arise from a defect in the title. A Florida quiet title attorney can help you understand the importance of these steps and can assist you in obtaining a clear title.

What is a Title Search?

A title search is a comprehensive examination of the public records related to a property. The purpose of a title search is to trace the history of ownership of the property and to identify any potential title defects. A title search will typically include a review of deeds, mortgages, liens, judgments, tax records, and other relevant documents. A title search is typically conducted by a title company or a real estate attorney.

What is Title Insurance?

Title insurance is a type of insurance that protects a property owner or lender against any losses that may arise from a defect in the title. Unlike other types of insurance, which protect against future events, title insurance protects against past events that may have created a cloud on the title. A title insurance company will issue a policy after conducting a title search and determining that the title is clear. If a title defect is discovered after the policy is issued, the title insurance company will defend the owner’s title and will pay for any losses.

The Difference Between Owner’s Title Insurance and Lender’s Title Insurance

There are two types of title insurance: owner’s title insurance and lender’s title insurance. Owner’s title insurance protects the property owner, while lender’s title insurance protects the lender. If you are purchasing a property with a mortgage, the lender will require you to purchase lender’s title insurance. Owner’s title insurance is optional, but it is highly recommended. A Miami quiet title lawyer can advise you on the benefits of owner’s title insurance.

Common Title Defects That Title Insurance Covers

Title insurance can protect you against a wide range of title defects. These include forged deeds or mortgages, where if a deed or mortgage was forged, it is not valid, and the property may not have been properly transferred. Title insurance also covers undisclosed heirs, where if a previous owner had heirs who were not disclosed, they may have a claim to the property. It covers errors in public records, such as a mistake in a legal description or a misspelled name, which can create a cloud on the title. Title insurance covers liens and judgments that were not discovered during the title search and can affect the owner’s rights to the property. It also covers easements and encroachments that were not disclosed and can limit the owner’s use of the property.

The Quiet Title Action and Title Insurance

While title insurance can protect you against many title defects, it does not cover all situations. If a title defect is discovered after you have purchased a property, you may need to file a quiet title action to clear the title. A quiet title action can be used to remove a cloud on the title that is not covered by title insurance. An experienced Florida quiet title attorney can help you determine if a quiet title action is necessary and can represent you in the lawsuit.

The Role of a Title Company in Real Estate Transactions

A title company plays a crucial role in real estate transactions in Florida. The title company is responsible for conducting the title search, issuing the title insurance policy, and handling the closing of the transaction. A reputable title company can help ensure that the transaction is completed smoothly and that the buyer receives a clear and marketable title.

Services Provided by a Title Company

A title company provides a wide range of services. For title search, the title company will conduct a thorough title search to identify any potential title defects. For title insurance, the title company will issue a title insurance policy to protect the buyer and the lender against any losses that may arise from a defect in the title. For escrow services, the title company will act as an escrow agent, holding the buyer’s funds until the transaction is completed. For closing services, the title company will handle the closing of the transaction, including the preparation and recording of the deed and other documents.

Choosing a Title Company

When choosing a title company, it is important to select a reputable and experienced company. Look for a title company that has a good reputation in the community and that has experience handling real estate transactions in your area. It is also important to compare the fees charged by different title companies. A Miami quiet title lawyer can recommend a reputable title company.

Quiet Title Actions and Real Estate Investments

For real estate investors, having a clear and marketable title is essential. A clouded title can make it difficult or impossible to sell or finance a property, which can significantly impact the return on investment. This is why many real estate investors use quiet title actions as a tool to acquire and clear properties. A Florida quiet title attorney can be an invaluable partner for real estate investors.

Using Quiet Title Actions to Acquire Properties

Real estate investors often purchase properties at tax deed sales, foreclosure auctions, or through other distressed sales. These properties may have clouded titles, which can make them difficult to sell or finance. A quiet title action can be used to clear the title and to make the property marketable. This can allow investors to acquire properties at a discount and to profit from the sale or rental of the property.

Due Diligence and Title Searches for Investors

Before purchasing any property, real estate investors should conduct thorough due diligence, including a comprehensive title search. A title search can help identify any potential title defects that may need to be addressed through a quiet title action. It is also important to obtain title insurance to protect against any unknown title defects. A Miami quiet title lawyer can assist investors with due diligence and can help them navigate the complexities of quiet title actions.

The Costs and Benefits of Quiet Title Actions for Investors

The cost of a quiet title action can vary depending on the complexity of the case. However, the benefits of a quiet title action can far outweigh the costs. By clearing the title, investors can make the property marketable and can increase its value. This can lead to a significant return on investment. A quiet title action can also provide peace of mind, knowing that the investor has a clear and legally sound title to the property.

Working with a Quiet Title Attorney for Real Estate Investments

Real estate investors should work with an experienced quiet title attorney to ensure that their investments are protected. A quiet title attorney can help investors identify potential title defects, can file and prosecute quiet title actions, and can provide guidance on all aspects of real estate law. A Florida quiet title attorney can be a valuable partner for any real estate investor.

Conclusion: Protecting Your Property Rights with a Quiet Title Action

A quiet title action is a powerful legal tool for resolving title disputes and for ensuring that you have a clear and marketable title to your property. Whether you are a homeowner, a real estate investor, or a business owner, having a clear title is essential for protecting your investment and for ensuring that you can sell, finance, or otherwise transfer your property. If you have any concerns about the title to your property, it is important to consult with an experienced Florida quiet title attorney. An attorney can help you identify any potential title defects, can advise you on your legal options, and can represent you in a quiet title action to clear your title. Do not let a clouded title jeopardize your property rights. Take action today to protect your investment and to secure your ownership rights.

Frequently Asked Questions (FAQ) about Florida Quiet Title Actions

1. What is a quiet title action in Florida?

A quiet title action is a lawsuit filed to resolve adverse claims and remove clouds from title so that ownership can be confirmed by court judgment. Florida’s quiet title statutes are found in Chapter 65, Florida Statutes.1 Quiet title actions can involve boundary and survey disputes, deed defects, recorded liens, forged or fraudulent instruments, tax deed issues, and competing claims of equitable ownership.

2. Do Florida courts have authority to award possession in a quiet title action?

Yes. Florida’s quiet title statute expressly authorizes courts to determine the plaintiff’s title against defendants and to award possession to the party entitled to it. See § 65.011, Florida Statutes.2

3. How do quiet title actions relate to tax deeds and statutory notice requirements?

Quiet title litigation can arise after tax deed sales. Florida Supreme Court precedent addresses how statutory notice requirements affect the validity of a tax deed and related quiet title claims.3 Because tax deed notice statutes are technical, quiet title actions involving tax deeds often turn on the record of notices, the tax collector’s information, and compliance with statutory procedures.3

4. Can I use a quiet title action to address a fraudulent deed or attempted conveyance?

Florida law provides specific tools for addressing fraudulent or attempted conveyances, including statutory provisions within Chapter 65. See, e.g., § 65.091, Florida Statutes.4 The procedural posture and relief can differ depending on whether the instrument is recorded, whether possession is at issue, and whether additional tort or damages claims exist.

5. How long do quiet title cases take?

Timing depends on service issues, the number of defendants (including unknown parties), whether title claims are contested, and whether summary judgment is realistic. Some Chapter 65 claims (including those involving fraudulent attempted conveyances) may be entitled to accelerated procedure in certain circumstances.4

6. What is the practical benefit of a quiet title judgment?

A quiet title judgment can “clear” the record, resolve competing claims, and improve marketability for sale or refinance. In many transactions, title insurers and lenders require resolution of certain defects or claims before closing.

Testimonials

-

“I used this law firm to advise me on commercial closings and landlord-tenant law. These attorneys are knowledgeable and efficient.”- Bryan S.

-

“Phil and his team were very professional and helped me throughout each step of the process. The case had a hearing that included the tenant in court. Phil was able to professionally state my case and quoted statutes that ended with a judgement in my favor.”- Brandon H.

-

“Due to the lawyer’s efforts, we ended up settling the lawsuit and recovering possession of both eviction properties within 3 weeks of filing both cases.”- Naomie O.

-

“I had an unlawful detainer case and he got the job done.”- Jason M.

-

“I used this law firm to evict my tenant on Hollywood Beach. They were running an daycare business out of the apartment we rented and they were subletting.”- Alexander K.

-

“One of my colleagues called this firm for information on doing a residential eviction for a single family home she rented in Hollywood, FL.”- Nicolas W.

-

“The staff at Revah Law were all very professional and responsive throughout the process.”- Otoniel L.

-

“Phil is an excellent attorney - precise, informative and very honest!”- Paul L.